By :- Shruti Tiwari

Several financial and regulatory changes come into effect from July 1, impacting railway fares, PAN card applications, credit card billing, and more.

New Delhi, July 1 – As with the beginning of every month, several key rules and financial regulations have been revised from July 1, 2025. These changes span various sectors including banking, taxation, transport, and public services. Here’s a comprehensive look at the new rules that could significantly impact your daily life and wallet:

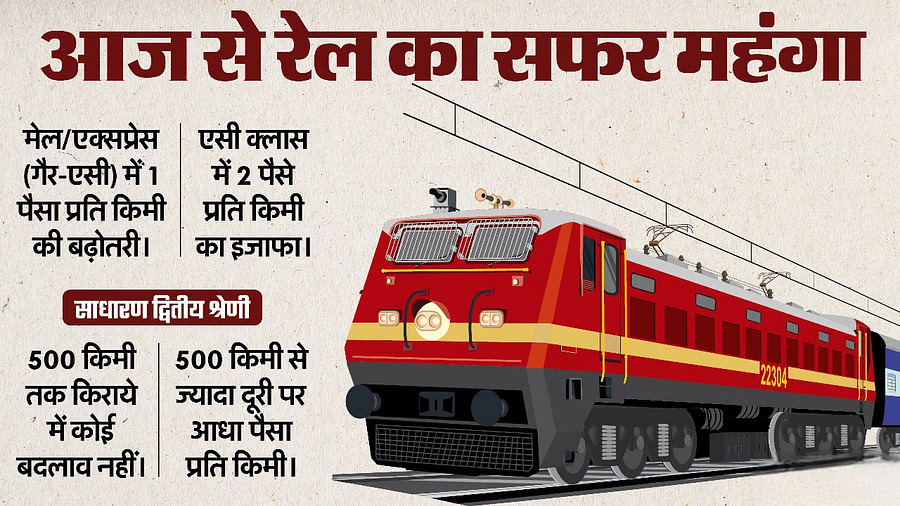

1. Railway Fare Hike for Long-Distance Travel

Train fares for both non-AC and AC classes have been increased for journeys exceeding 1,000 kilometers. The fare for non-AC class has gone up by 1 paisa per kilometer, while AC class tickets are now costlier by 2 paisa per kilometer.

For second-class passengers, there will be no change in fare up to 500 kilometers. Beyond that, passengers will have to pay an additional 0.5 paisa per kilometer.

2. Aadhaar Mandatory for Tatkal Train Ticket Booking

Tatkal train tickets can now only be booked through IRCTC accounts linked with Aadhaar. An OTP-based verification system, sent to the Aadhaar-linked mobile number, has been implemented. Additionally, railway agents are barred from booking Tatkal tickets for the first 30 minutes after bookings open.

3. Aadhaar Now Compulsory for PAN Card Application

From July 1, it is mandatory to provide an Aadhaar number while applying for a new PAN card. Furthermore, all existing PAN card holders must link their PAN with Aadhaar by December 31, 2025. Failure to do so will result in the PAN becoming inactive from January 1, 2026.

4. GST Return Filing Gets Stricter

The GST return filing process has been revised. From now on, the GSTR-3B form will auto-fill using details from GSTR-1 and GSTR-1A and cannot be manually altered. This change aims to bring greater transparency and reduce errors or discrepancies in tax reporting.

5. Changes in Bank Charges and Credit Card Fees

Leading banks including Kotak Mahindra, ICICI, Axis Bank, and HDFC Bank have revised several service charges:

- Increased charges for ATM withdrawals beyond the free limit.

- Changes in savings account interest rates.

- Updates in credit card annual and late payment fees.

These changes are expected to directly affect bank customers.

6. Revised Interest Rates on Small Savings Schemes

The government is expected to revise the interest rates on small savings schemes such as PPF, NSC, and Sukanya Samriddhi Yojana. The updated rates, once announced, will remain effective from July 1 to September 30. Due to recent repo rate cuts by the RBI, a reduction in interest rates is likely.

7. Extended Deadline for Income Tax Return Filing

The deadline for filing income tax returns (ITR) for the assessment year 2025–26 has been extended from July 31 to September 15, 2025. This extension provides salaried taxpayers with an additional 46 days to file their returns.

8. New Credit Card Bill Payment System Implemented

The Bharat Bill Payment System (BBPS) is now mandatory for all credit card bill payments. According to the Reserve Bank of India, all payments must be routed through BBPS. This could affect apps like BillDesk, PhonePe, and Cred which previously handled credit card payments outside BBPS. Currently, only 8 banks are offering BBPS-based credit card payment services.

Conclusion:

These rule changes, effective from July 1, 2025, are part of a larger push toward digital integration, transparency, and regulatory compliance. From daily commuting costs to essential banking services, staying informed about these updates is crucial to managing personal finances efficiently.