June 24, 2025

By – Shubhendra Singh Rajawat

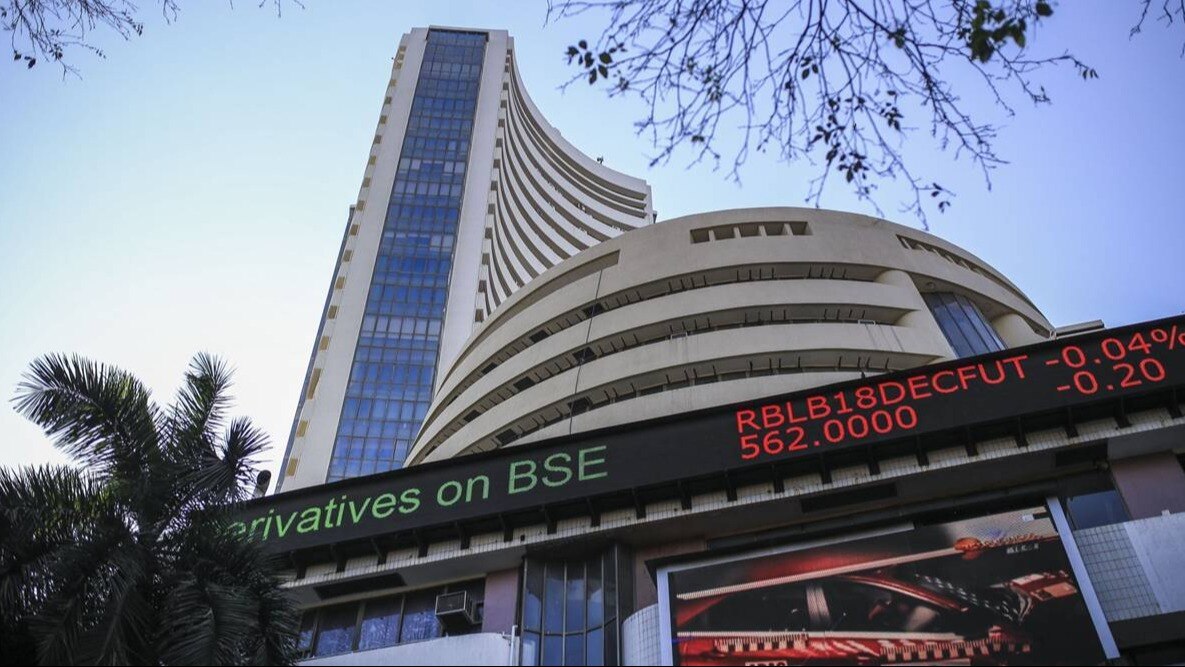

Indian stock markets witnessed a robust rally on Tuesday, buoyed by signs of easing geopolitical tensions in West Asia. Reports of a potential ceasefire between Israel and Iran led to widespread optimism, triggering a sharp surge in domestic indices and a rally in Asian markets.

Markets Open with a Bang

After a subdued performance on Monday, where the BSE Sensex dropped by 511.38 points to close at 81,896.79 and the NSE Nifty declined by 140.50 points to end at 24,971.90, markets bounced back with force on Tuesday.

At the opening bell, the Sensex leapt 930.7 points to touch 82,827.49, while the Nifty jumped 278.95 points, breaking the key 25,250 level to reach 25,250.85.

Currency and Crude Reaction

The positive market sentiment was mirrored by the currency market as well. The Indian Rupee appreciated by 68 paise against the US Dollar to trade at 86.10 in early trade.

Meanwhile, global crude oil prices slipped significantly. Brent crude, the international benchmark, fell 2.87% to trade at $69.43 per barrel, providing additional comfort to the Indian economy, which is heavily reliant on oil imports.

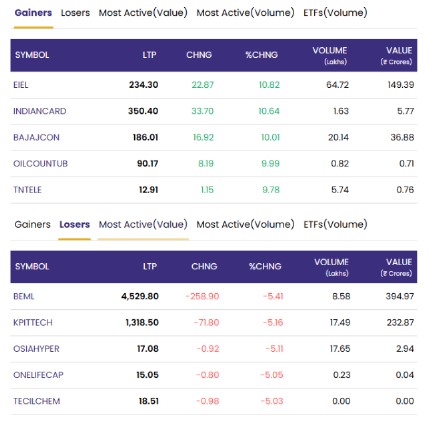

Who Gained, Who Lost?

Among the top performers on the 30-stock BSE Sensex were:

- Adani Ports

- UltraTech Cement

- Mahindra & Mahindra

- Larsen & Toubro

- Axis Bank

- Asian Paints

On the flip side, NTPC and Bharat Electronics were among the laggards in an otherwise bullish market.

According to exchange data:

- Foreign Institutional Investors (FIIs) sold equities worth ₹1,874.38 crore on Monday.

- Domestic Institutional Investors (DIIs) were net buyers, purchasing stocks worth ₹5,591.77 crore.

Global Cues Provide Relief

The market rally was partly fueled by a statement from U.S. President Donald Trump, who indicated progress towards restoring peace in West Asia. The announcement eased geopolitical worries that had recently weighed on investor sentiment, offering relief to global investors.

The NSE Nifty 50 opened 208 points higher at 25,179.90, a gain of 0.83%, while the BSE Sensex climbed 637.82 points, or 0.78%, to open at 82,534.61. At one point, the Sensex surged over 900 points, and the Nifty gained more than 250 points, signaling strong investor confidence.

What Do Experts Say?

Market experts noted that the easing tensions between Israel and Iran have led investors to refocus on upcoming global economic events that could shape future trends.

A key date on the radar is July 9, tied to potential U.S. tariff decisions. Analysts believe that if trade-related uncertainties are resolved or postponed, the bullish momentum in equities may continue.

Asian and U.S. Markets Also Rally

The ripple effect of the ceasefire hopes was felt across Asian markets:

- Japan’s Nikkei 225 jumped over 1%.

- Hong Kong’s Hang Seng Index climbed 2%.

- South Korea’s KOSPI rallied 2.86%.

- Taiwan’s Weighted Index surged 1.85%.

Overnight, U.S. markets also closed in the green, reinforcing the global optimism that peace in the West Asian region could stabilize global trade and energy markets.

Conclusion

With geopolitical tensions appearing to cool and global cues turning favorable, investor sentiment in Indian equities remains buoyant. However, experts advise investors to remain cautious and watch key global developments, particularly around trade policies and macroeconomic indicators.